Bridges Insights

Bridges Insights is our not-for-profit field-building arm. It works to build the market for sustainable and impact investing through collaborative projects and thought-leadership.

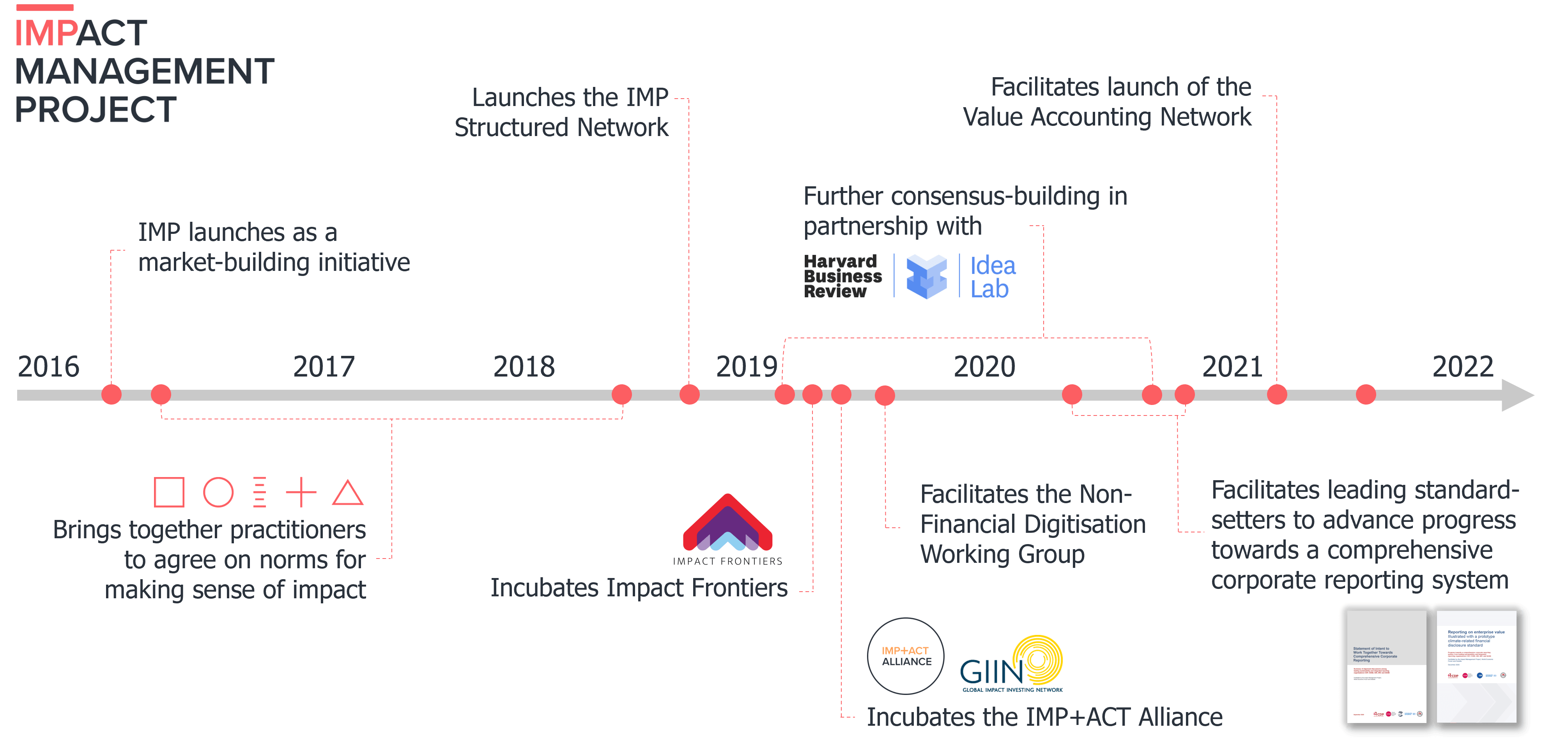

The primary focus of our recent field-building work has been the Impact Management Project, which Bridges Insights launched in 2016 and hosted/ facilitated until its conclusion in 2021.

In its initial phase, this ground-breaking initiative brought together over 2,000 organisations from across the global value chain to agree on shared fundamentals for how we measure, manage and report on impacts on people and the natural environment. This work is now being continued by The Impact Management Platform.

Since 2018, the IMP's primary focus was coordinating the Structured Network – an unprecedented collaboration between 15 of the world’s leading standard-setters. Through their specific and complementary expertise, these organisations worked collaboratively to provide comprehensive, interoperable standards and guidance for impact measurement, assessment and reporting.

A subset of the Network members went on to co-create a shared vision for corporate reporting, as well as a joint paper on how standards and frameworks for sustainability-related financial disclosure can be used together. This work provided a running start for the IFRS Foundation's creation of the International Sustainability Standards Board (ISSB), which will sit alongside the International Accounting Standards Board.

From March 2021, under the strategic direction of the IFRS Foundation’s Steering Committee of Trustees, members of the IMP team led the IFRS Foundation’s development of the ISSB, which was launched at COP26.

Impact Frontiers

In addition to the efforts of the Structured Network, we recognised the importance of bringing practitioners together to work on how to implement this thinking into our day-to-day activities.

As a result, Bridges incubated Impact Frontiers, a learning and innovation collaboration of investors and field-builders dedicated to advancing the integration of impact into financial frameworks, processes, and decision-making.

The Insights team also worked in partnership with Harvard Business Review on an Idea Lab, an online platform that allows anyone to participate in technical discussions about emerging areas of practice.

The IMP+ACT Alliance

If we want to ensure the broadest possible take-up of these emerging standards, digitisation is key. That’s why from August 2018 to August 2021, Bridges Insights supported the facilitation of the IMP+ACT Alliance, a public good technology initiative funded by the City of London Corporation, Deutsche Bank and UNDP SDG Impact.

Together with over 150 organisations, the IMP+ACT Alliance developed the IMP+ACT Classification System (ICS), a free self-assessment and reporting tool for investors wanting to integrate impact into their investment decisions, investment practice and performance analysis. In May 2021, the IP and Code for the ICS was donated to the field and is available on Github (MIT licence; search for ICS-codebase). Following the successful roll-out to over 300 practitioners, in July 2021 the management of the platform was transferred to the GIIN, to further expand its reach through connection with the GIIN’s IRIS+ system.

Proprietary research & knowledge-sharing

Over the years, we have published a number of papers on topics where we felt our experience of sustainable and impact investing could help support the growth of the broader market.

Previous examples include the Bridges Spectrum of Capital; a case study of how Skopos Impact Fund developed its impact management framework; a look at the future for outcomes contracts in the UK; and an analysis of the investment case for B Corporations.