An integrated approach

Most members of the impact management team are fully integrated into our investment teams to support across the deal cycle and lead impact-driven value creation initiatives. These team members bring deep technical expertise to each investment, whilst also facilitating a knowledge-sharing network across Bridges and with external parties. This coordinated ‘hub-and-spoke’ function enables us to operate our approach with consistency across strategies, whilst ensuring resource is dedicated to continuous improvement, ongoing industry engagement and market-building efforts.

Deep technical expertise

Between 2016-2021, members of the Bridges team facilitated the Impact Management Project, working with industry leaders and standard-setters. This has given us a unique perspective on the evolution of best practice in this area.

Bridges’ own impact management approach is aligned with regulatory and industry principles and standards of practice, including the Principles of Responsible Investment (PRI), the Operating Principles for Impact Management (OPIM) and the UNDP SDG Impact Standards for Private Equity Funds. Building high-quality processes ensures our performance information is complete and accurate, which in turn helps us comply with regulation such as the EU’s SFDR.

We also support our investments to adopt corporate standards to ensure comparability of performance information: for example, using standardised disclosures and reporting frameworks (such as GRI, ISSB/VRF and B Lab), alongside issue-specific thresholds and frameworks (such as the Science-Based Targets Initiative and the Taskforce for Climate-Related Financial Disclosures (TCFD)). We also refer to the OECD MNE guidelines, UN Global Compact and Social Value International Principles for establishing processes and setting objectives.

Committed to action

For us, impact management is more than just collecting data about what our investments already do. We use data about an investment’s impacts on sustainability to take action, and we prioritise actions that result in the creation of value for all stakeholders. Indeed, understanding the complex relationship between impact and commercial considerations has been critical to building our truly integrated approach.

We are committed to learning and actively seek to improve our approach with each fund. This culture of improvement also enables us to adapt as the world around us also changes.

Transparency on goals

Greater market consistency – from shared definitions to integrated sustainability accounting standards – will ultimately enable more capital to flow towards a more inclusive and sustainable economy. We continually update our approach to adhere to these emerging standards, while sharing our approach and goals transparently.

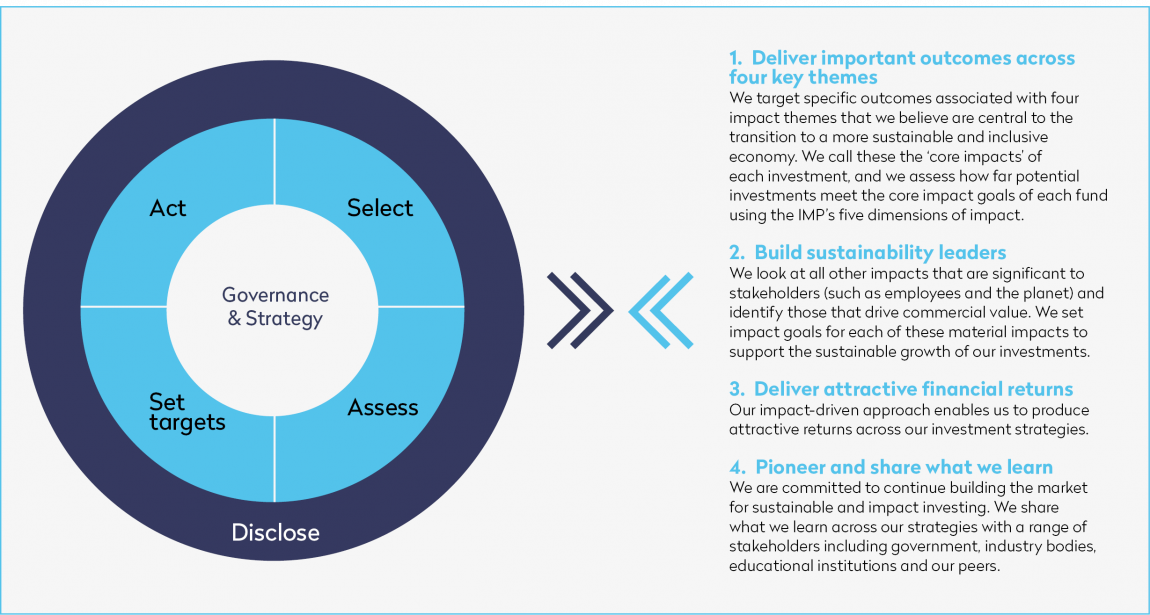

In this evolving industry, we think it is important to use market-wide standards to execute on our strategy, rather than create a proprietary framework. The diagram below – based on the consensus agreed between standard-setters through the Impact Management Platform – represents the core features of our integrated impact management process, which is based on internationally agreed principles and standards.

For more detail on how our integrated impact management approach enables us to deliver against our goals, please view our:

- Sustainable Investment Policy

- Sustainable Property Policy

- PRI disclosure

- B Corporation assessment

- SFDR disclosures

- TCFD statement

- PRI Transparency Report 2023

Bridges x IMP: Industry-leading expertise

From 2016-21, members of the Bridges Impact Management Team were seconded to Bridges Insights, our not-for-profit field-building arm, to facilitate an ambitious initiative called the Impact Management Project.

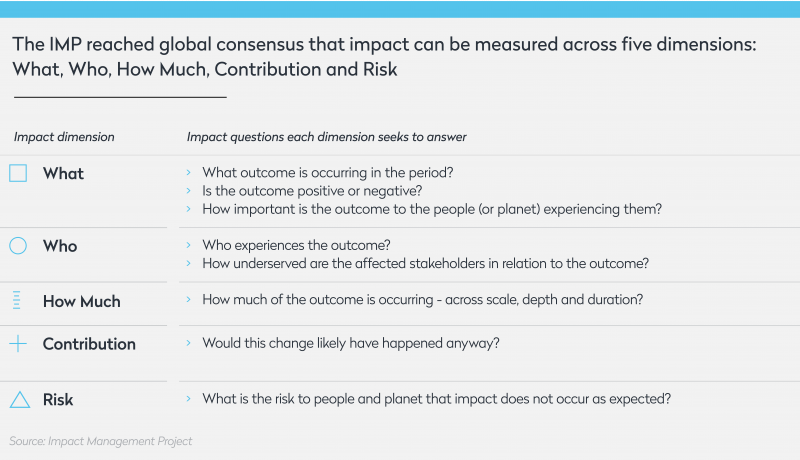

In its first two years, the IMP brought together over 2,000 organisations to agree on shared norms, such as the five ‘Dimensions of Impact’ that enable enterprises and investors to assess and compare their impacts on people and the planet; and impact classes, a classification system for investment products.

In its second phase, the IMP facilitated a ‘Structured Network’ of 16 of the world’s leading standard-setters – including UN agencies, the OECD, and leading corporate reporting initiatives – to coordinate efforts to provide a comprehensive system of standards for managing and disclosing impacts on sustainability.

The Network resulted in two outputs, both of which will be vital to the ongoing development of impact management practice:

- The Impact Management Platform, which launched in November 2021, is an evolution of the IMP: a collaboration to mainstream the practice of impact management, led by leading international providers of sustainability resources and chaired by OECD and UNEP-FI. The Platform’s website outlines the core actions of impact management, and links to the resources that help organisations and investors implement them.

- A subset of the Network members – the leading sustainability and integrated reporting initiatives (CDP, CDSB, GRI and the VRF) – co-created a shared vision for corporate reporting, as well as a joint paper on how standards and frameworks for sustainability-related financial disclosure can be used together. This work provided a running start for the creation of the International Sustainability Standards Board (ISSB) by the IFRS Foundation, which sits alongside the International Accounting Standards Board. From March 2021, members of the IMP team led the IFRS Foundation’s development of the ISSB, under the oversight and strategic direction of the IFRS Foundation’s Steering Committee of Trustees, which launched at COP26.